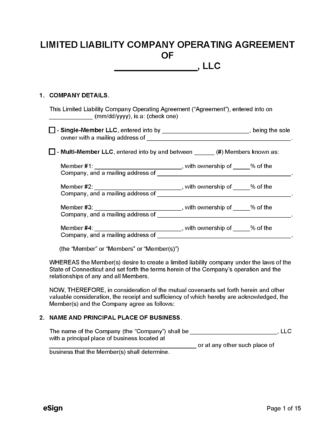

A Connecticut LLC operating agreement is used by the member(s) of a limited liability company to identify the entity’s ownership and describe how the business shall operate and be managed. The agreement explains how the company will maneuver certain events, such as profit distribution, losses and deductions, member voting, and company tax returns. It also distinguishes the company from its members, thus protecting each individual from personal liability.

Although an operating agreement is not legally required in Connecticut, LLCs are strongly advised to draft one immediately after receiving approval to conduct business within the state.

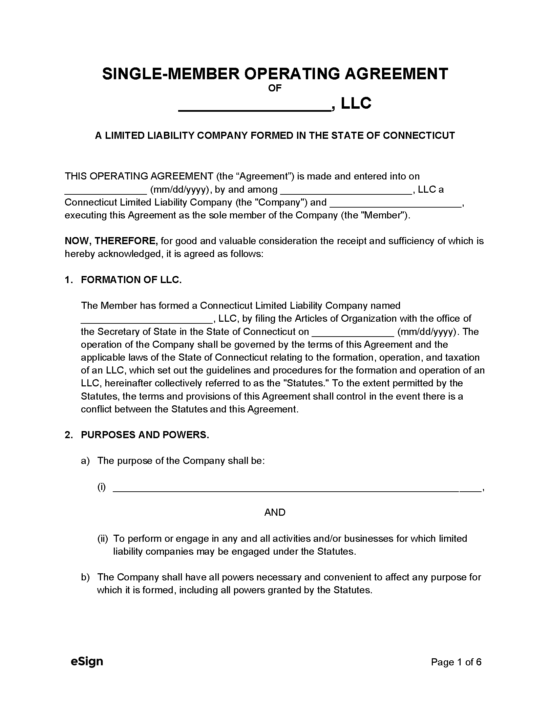

Single-Member LLC Operating Agreement – This operating agreement should be used if the LLC has one (1) owner.

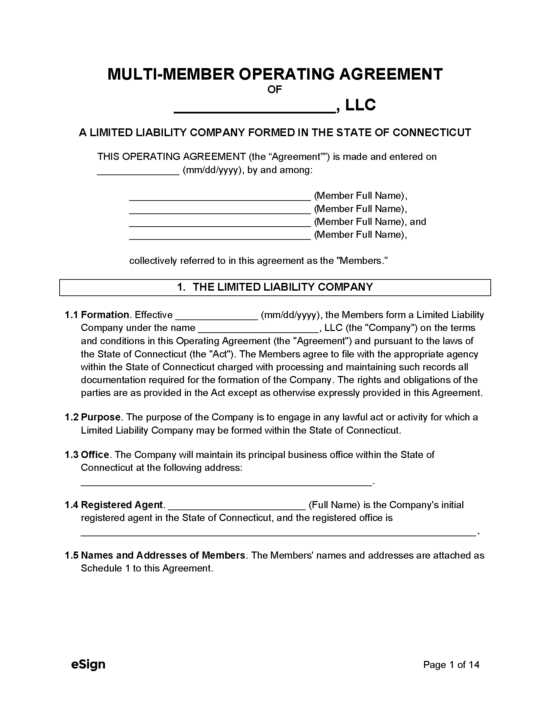

Multi-Member LLC Operating Agreement – LLCs may use this operating agreement if the company has more than one (1) owner.

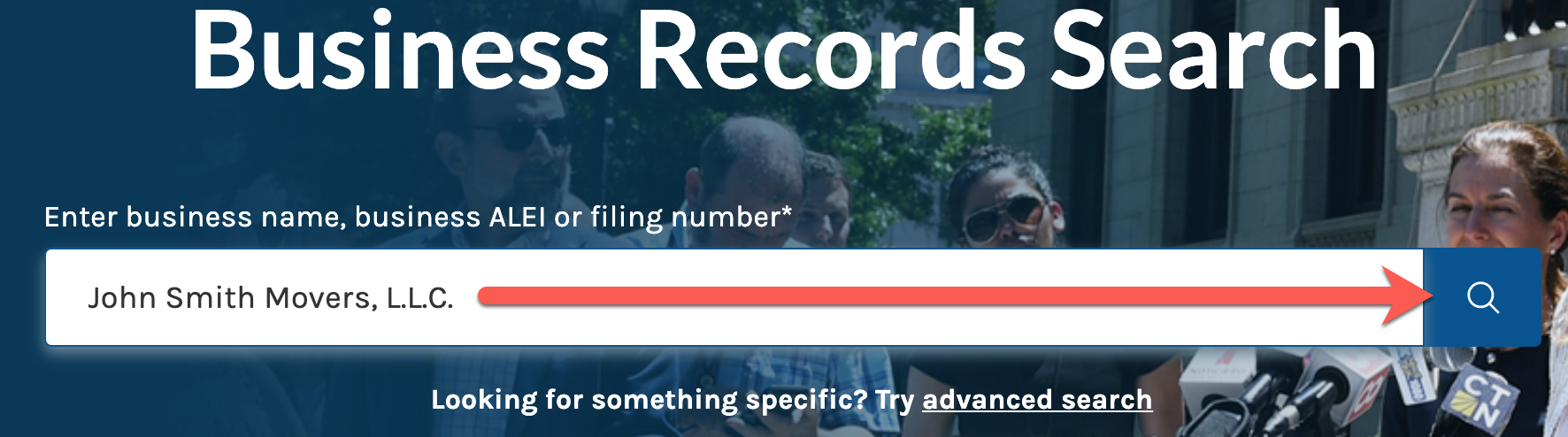

Business filers will need to choose a company name that is distinguishable from all others currently recorded with the Secretary of State. Perform a Business Records Search to determine whether the proposed entity name is unique.

Connecticut statute § 34-243k indicates that the company name must include a proper business designation, such as “LLC,” “L.L.C.,” or “Limited Liability Company.”

Filers have the option of reserving the intended name for one hundred and twenty (120) days. For reservations, fill out the Application for Reservation of Name, attach a check for $60 made payable to the “Secretary of State,” and mail or deliver the items to the applicable address below:

A registered agent is an individual or entity that acts on behalf of the LLC to receive notices, demands, and service of process (court documents). In Connecticut, a registered agent may be either of the following:

Registering the business entity with the Secretary of State is accomplished by filing the Certificate of Organization (for domestic LLCs) or the Foreign Registration Statement (for out-of-state LLCs).

Limited liability companies are not required to file an operating agreement with the Secretary of State. Despite this fact, LLCs are advised to draft one to establish the company’s rules, regulations, and ownership structure.

Filing Options: Online, Mail, & In Person

Costs:

Forms:

Links: